Kamalnath Sathyamurthy

Data Scientist with over 6 years of broad-based experience in ETL (Extract, Transform and Load) testing of data intensive applications, creating and deploying complex user stories to build substantial deliverables as per business requirements | Proficient in creating effective visualizations and developing complex forecast and regression models | Thriving to improve myself by engaging in challenging research areas and business needs.

Master's in Data Science @ The State University of New York, Buffalo

View My LinkedIn Profile

CREDIT CARD CUSTOMER SEGMENTATION

Project description: The credit card has become the primary mode in which consumers pay for purchases today providing convenience, security and the opportunity to earn rewards in today’s world customers expect user-friendly services from financial institutions and hence financial institutions provide user-oriented offers based on customer needs and in that, customer segmentation plays a huge role in shaping the business strategy. The data of customer financial behavior is collected, preprocessed and the customers are clustered using different clustering techniques based on that the banks can identify customers with similar spending habits and can target the customers of different groups using custom made offers and also help banks to find potential customers who may leave bank and banks can target them with special offers and also identify customers with the poor financial condition and avert the risk of customers who can go default and this paper also creates visualization tool using r shiny which can provide the banks great value.

1. Motivation and Significance

Customer Segmentation is an integral part of the development of marketing objectives and strategies, where defining those objectives will generally include either:

a. an analysis of how products should be sold or developed

b. identification of new segments as targets for existing products or the development of new products/features.

Segmentation is critical because when a company has limited resources it must focus on how to best identify and serve its customers. Effective segmentation allows a company to determine which customer groups they should try to serve and how to best position their products and services for each group. Credit card customer segmentation also helps the companies to identify the frauds. A corporation can use effective segmentation to figure out which client groups they should target and how to best position their products and services for each group. Performing clustering based on a machine learning model helps achieve better accuracy and easier methods to target new customers and existing customers.

2. About Dataset

The sample Dataset summarizes the usage behavior of about 9000 active credit cardholders during the last 6 months. The credit card data has 17 attributes for each customer which include the balance (credit owed by the customer), a cash advance (when a customer withdraws cash using the credit card), the customer’s credit limit, minimum payment, percentage of full payments and tenure.

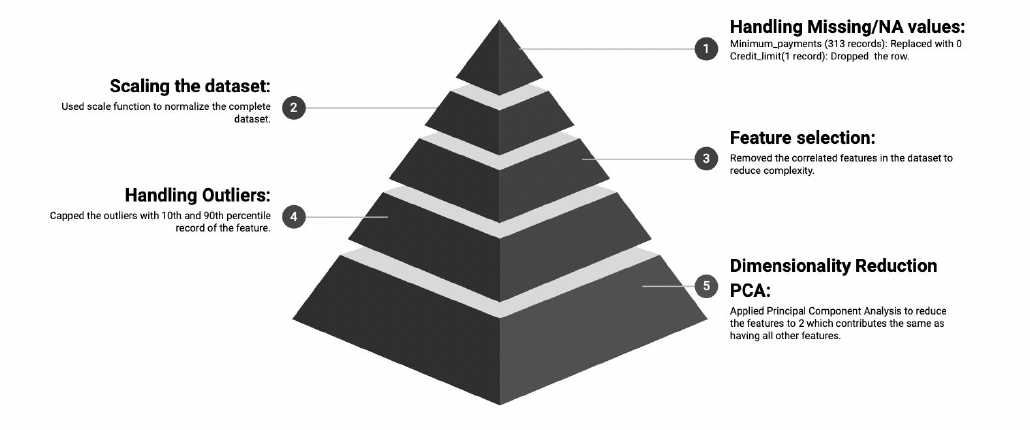

3. Data Pre-processing

4. Exploratory Data Analysis

5. Clustering

Choosing Optimal Clusters:

* Elbow Method

* Silhouette Method

* Gap Statistics

Optimal cluster value obtained using above techniques is 5.

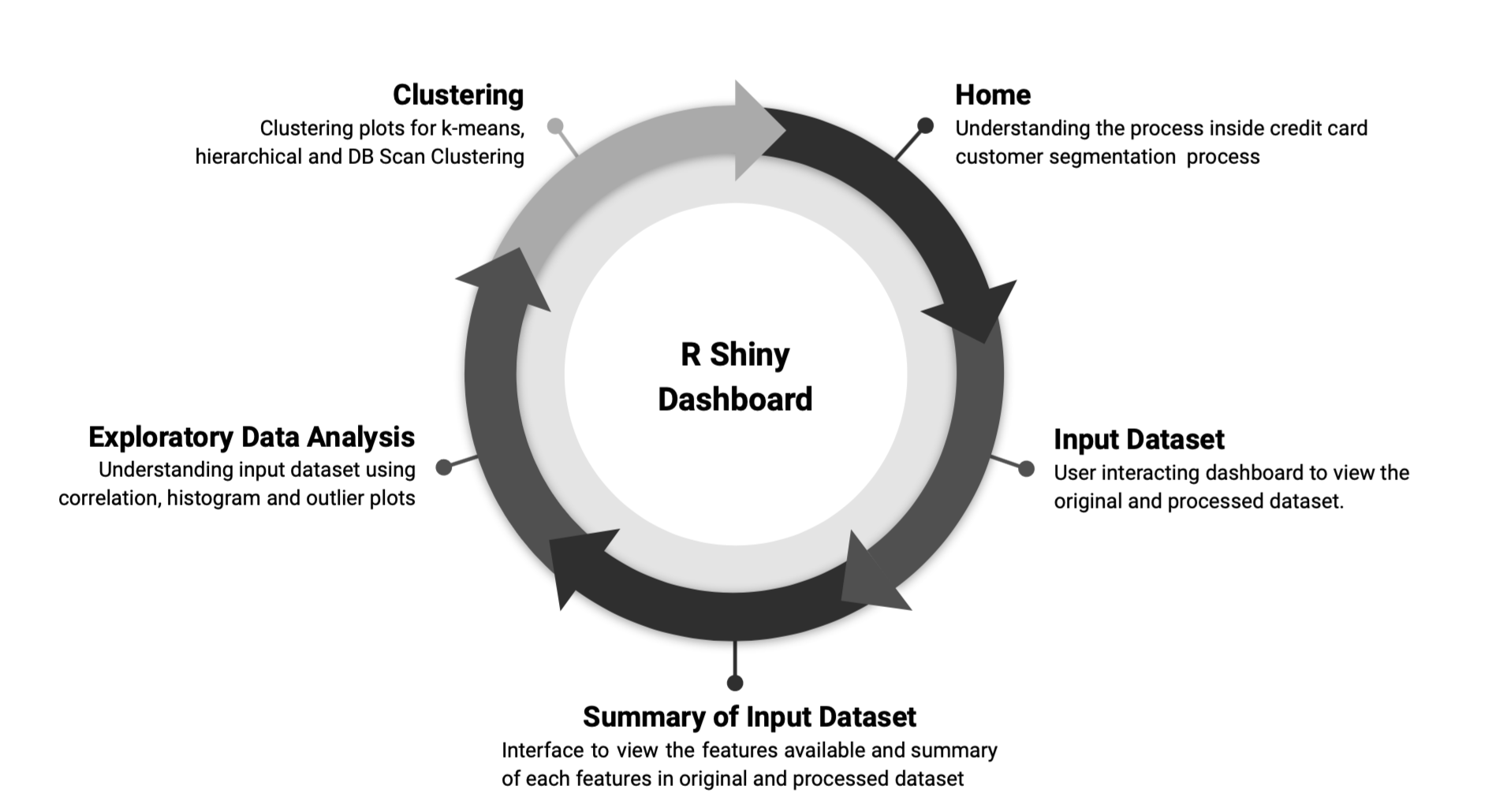

6. R Shiny Implementation